Machinery users increasingly turn to secondhand gear, as global market slump persists

A Ritchie Bros. auction in Nisku, Alberta, on April 26. Trends toward leases and rentals are creating larger fleets of used equipment that trickle down the value chain. Machinery gluts can be lengthy because such equipment can last a quarter of a century or longer.

Used machinery is flooding the secondhand market, piling more pain on equipment makers battling slack demand from any customer that mines, moves or refines commodities amid a global slump in the value of everything from coal to corn.

Instead of buying a new $500,000 bulldozer or $300,000 excavator, many construction firms and other equipment users are renting or entering longer-term leases for machines to expand their fleets or replace worn out equipment, dealers and analysts say. Dealers, in turn, are keeping smaller inventories of new wheel loaders, backhoes and other machinery. That is hurting sales for Caterpillar Inc., Volvo AB, Deere & Co. and other manufacturers.

Machinery gluts can be lengthy because such high-price equipment can last a quarter-century or longer. The strong U.S. dollar also is damping demand from developing African and Asian markets that once snapped up used machines. Trends toward leases and rentals are creating larger fleets of used equipment that trickle down the value chain into a crowded secondhand market.

“There’s a lot of machinery sitting around,” said Bill Yurkovic, used equipment manager for Cleveland Brothers Equipment Co., a Caterpillar dealer in Pennsylvania and West Virginia. Demand there for dump trucks that cost more than $1 million and other large earth-moving machinery crashed along with prices for the coal and natural gas the region produces.

“It’s as bad as it’s been in my 30 years,” Mr. Yurkovic said. “A lot of renting. Not a lot of buying.”

With so much equipment up for grabs, used-machinery prices are down 10% from a year ago, Caterpillar says. Its dealers also are under pressure to keep up with price discounts on competitors’ new equipment. Lower prices for new machines provide further downward pressure on used values.

Auctioneers like Vancouver, British Columbia-based Ritchie Bros. Auctioneers Inc.—North America’s largest—caution that equipment volumes and sale prices can be volatile from month to month.

“It’s a lumpy business and you have to be very careful how you manage it,” said Ravi Saligram, chief executive of Ritchie, which last month said it planned to acquire its main rival—Pleasanton, Calif.-based IronPlanet Inc.—for $758.5 million.

Rental businesses account for half of new equipment sales in the U.S., and some analysts see that climbing to 60% within five years. Rental businesses typically replace their equipment within three years, providing a consistent supply of late-model machines for the used market.

“You see new people coming into an area to do a project and renting all of their equipment,” said Mark Kozik, owner of Scranton Craftsmen Inc., a Pennsylvania-based building contractor.

Contractors are increasingly choosing to lease instead of buy new equipment. Leases allow them to pay less up front, especially when the manufacturers’ financing arms offer attractive lease rates—lower than the cost of shorter-term rentals.

“A guy can lease a machine for a year or two and pay as little as one-third of what he could get it for as a rental,” said Frank Fowler, senior vice president of used equipment at Ring Power, a Caterpillar dealer in St. Augustine, Fla.

While leasing a new construction crane or compact skid-steer loader is as good for a manufacturer’s production volume as selling it outright, a leasing splurge can create unwanted competition for new models by flooding the used market with machines.

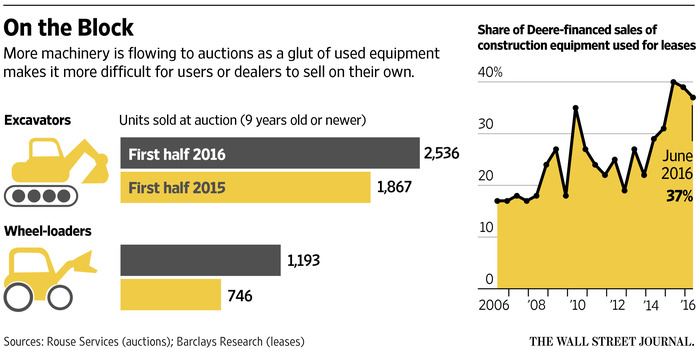

According to Barclays Research, almost 40% of construction-equipment sales financed by Deere’s credit unit are for leases, up from about 30% two years ago and double a decade ago. Half of Volvo’s financed construction-equipment sales are for leases, up from a quarter 10 years ago, according to Barclays. Volvo declined to comment on its strategy for used equipment and leases. Deere said it has recently lengthened lease terms and raised payments to drive down residual values at the end to of the leases to reflect lower prices for used equipment.

Auctioneers are also seeing rising sales from the used-equipment glut. Dealerships, rental companies and equipment-fleet operators are resorting to auctions, where turnover is quick but prices are typically lower, to get rid of equipment they can’t sell themselves.

Auction sales of construction and mining machinery tracked by Rouse Services of Beverly Hills, Calif., were up 19% in first half of this year from same period in 2015. The volume of equipment sold at auction rose more than a third in the first half of this year.

Mike Jeffries, general manager of United Contractors, a highway-bridge builder in Iowa, has warmed to IronPlanet as a great way to update his fleet more quickly than combing through used models on dealers’ lots.

“When the economy is down, that’s a good time to update equipment,” he said. “We’re trying to get rid of our older equipment and then buy newer stuff.”